Case Study - Building a Scalable Spend Management Platform for Modern Businesses

We partnered with Spendive to design and develop a powerful web and mobile platform that helps organizations control spending, automate procurement, and improve financial visibility.

- Client

- Spendive

- Year

- Service

- Fintech & SaaS Development

Overview

Spendive needed to build a comprehensive spend management platform to help businesses gain control over their financial operations. The challenge was creating a secure, scalable system that could handle complex approval workflows, vendor management, and real-time financial analytics — all while providing seamless access across web and mobile devices.

The platform needed to:

- Support multi-level approval workflows for different spending categories

- Provide real-time visibility into company spending and procurement

- Enable distributed teams to manage finances from anywhere

- Ensure enterprise-grade security and compliance

- Scale to support growing organizations with complex financial structures

Traditional development approaches — building an in-house team or working with project-based agencies — would have been too slow and expensive for a startup racing to market. Spendive partnered with us through a monthly subscription to get a complete product team dedicated to building their vision.

What we did

- Product Design & UX

- Web Application Development

- iOS & Android Mobile Apps

- API & Backend Infrastructure

- Multi-level Approval System

- Financial Reporting & Analytics

- Integration Architecture

- Cloud Deployment & DevOps

The Solution

We built a complete fintech platform that enables businesses to control spending, automate approvals, and gain real-time financial insights across any device.

Product Design

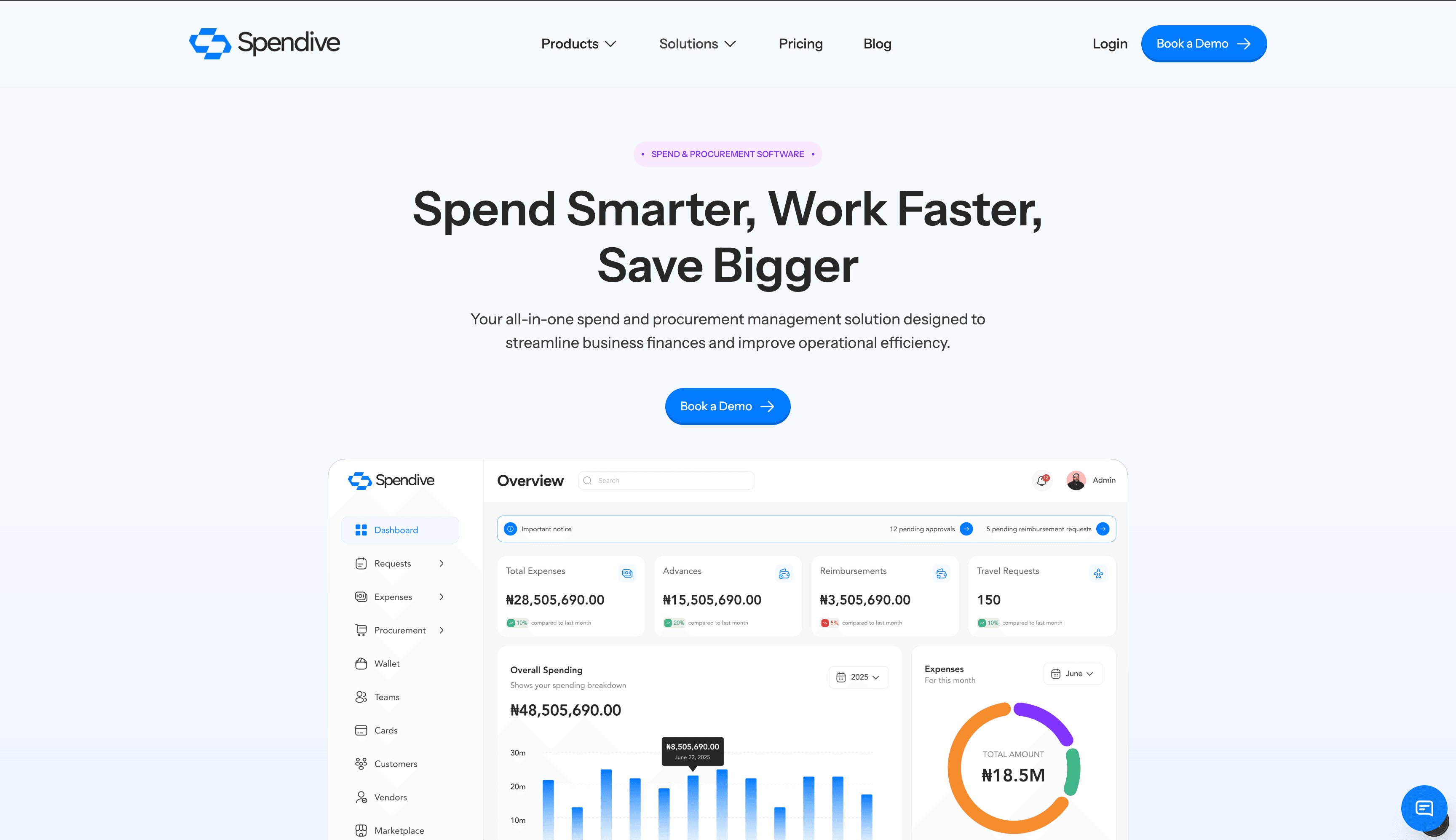

We designed a finance-focused dashboard experience optimized for different user roles — finance teams, managers, and employees. The interface prioritizes clarity, efficiency, and quick decision-making, with role-based views that show only relevant information to each user.

Key design considerations:

- Clean, data-dense dashboards without overwhelming users

- Intuitive approval flows that minimize friction

- Mobile-first expense capture and approval experience

- Consistent design system across web and mobile platforms

Web Application

The web platform provides comprehensive financial management capabilities:

- Purchase Request & Procurement – Submit, track, and manage purchase requests across the organization

- Multi-level Approval Workflows – Configurable approval chains based on amount, category, and department

- Vendor Management – Centralized vendor database with payment tracking and history

- Bill & Expense Tracking – Automated bill payments and expense categorization

- Real-time Analytics – Financial dashboards with spending insights and budget tracking

- Role-based Permissions – Granular access control for different organizational roles

Mobile Apps (iOS & Android)

We developed native mobile applications to enable financial operations from anywhere:

- On-the-Go Approvals – Review and approve purchase requests instantly from mobile

- Expense Capture – Scan receipts and submit expenses with automatic categorization

- Push Notifications – Real-time alerts for approvals, status updates, and budget alerts

- Offline Capability – Access key financial data and prepare submissions without connectivity

- Cross-Platform Sync – Seamless continuity between web and mobile experiences

Backend & Infrastructure

We built an enterprise-grade backend architecture designed for security and scale:

- RESTful API – Powers both web and mobile applications with consistent data access

- Secure Authentication – Multi-factor authentication and role-based access control

- Integration Architecture – Built to integrate with payment processors and ERP systems

- Cloud Infrastructure – Scalable deployment on AWS with automated backups

- Audit Trails – Comprehensive logging for compliance and financial auditing

- Performance Optimization – Fast response times even with large transaction volumes

The subscription model allowed us to build a complex fintech platform quickly without the overhead of hiring a full internal team. We shipped web and mobile simultaneously with enterprise-grade security and scalability.

CEO, Spendive

Key Features

Multi-level Approval Workflows – Configurable approval chains based on spending rules

Purchase Request & Procurement – End-to-end procurement management system

Expense & Bill Tracking – Automated expense categorization and bill payment tracking

Vendor Management – Centralized vendor database with payment history

Financial Dashboards – Real-time spending analytics and budget monitoring

Role-based Permissions – Granular access control for different user types

Real-time Notifications – Push alerts for approvals, payments, and budget thresholds

Web & Mobile Sync – Seamless experience across desktop and mobile devices

Results

- Faster approval cycles

- 60%

- Reduction in manual processes

- 50%

- Platforms from one team

- 3

- Additional hiring costs

- $0

By using our subscription model, Spendive was able to:

- Launch faster – Simultaneous web and mobile deployment without lengthy hiring processes

- Reduce operational costs – Complete product team for a predictable monthly fee

- Ensure enterprise quality – Built-in security, compliance, and scalability from day one

- Maintain velocity – Continuous feature delivery and improvements based on user feedback

- Scale confidently – Infrastructure designed to support enterprise customers

The platform now serves businesses of all sizes, processing thousands of approval requests and providing critical financial visibility to CFOs and finance teams.

Technology Stack

- Laravel

- Vue.js

- React Native

- REST API

- PostgreSQL

- Redis Caching

- AWS Cloud Infrastructure

- CI/CD Pipeline

Why the Subscription Model Worked

The monthly subscription model was essential for building a complex fintech platform:

- Continuous Delivery – New features and improvements shipped every week

- One Team, Multiple Platforms – Design, backend, web, iOS, and Android from a single dedicated team

- Predictable Costs – Fixed monthly fee instead of unpredictable project invoices or hiring costs

- Security & Compliance – Built-in expertise in fintech security and best practices

- Iterative Development – Ability to adjust features based on early customer feedback

- Long-term Partnership – Ongoing support and evolution as the business grows

Building a fintech or SaaS product?

Get a complete product team for a flat monthly fee and launch faster.

Whether you're building financial software, enterprise SaaS, or a complex web platform, our subscription model gives you the expertise and flexibility to ship continuously without the cost and complexity of hiring an entire team.